For many South Africans receiving social grants from the South African Social Security Agency (SASSA), these payments provide a critical lifeline and financial support. However, there is often confusion around what happens if you don’t claim or withdraw your SASSA grant money right away. Can these grants expire if left unclaimed? Today, we’ll explore this issue in-depth based on the latest information.

Do SASSA Grants Expire After a Certain Time?

The short answer is yes, SASSA grants can potentially expire or lapse if they are not claimed or withdrawn within a specific time frame. According to SASSA’s policies, grant recipients have a window of 90 days (3 months) to access and withdraw their grant money before it is considered “lapsed” or suspended.

During this 90-day period, the funds remain available in the recipient’s SASSA card or bank account (if paid directly). However, if there is no activity or withdrawal made within those 3 months, SASSA will suspend the grant account. At this point, the unclaimed money is at risk of being reclaimed by the government for other social programs.

It’s important to note that this 90-day lapse period applies in cases where there is absolutely no activity or withdrawal from the grant account. As long as there is some movement or spending from the account during that time, even a minor amount, the grant will remain active.

What Happens If Your SASSA Grant Lapses?

If your SASSA grant does lapse after 90 days of inactivity, you still have a chance to reinstate it and access any outstanding payments owed to you. However, you only have that same 3-month window to apply for reinstatement before the grant is permanently canceled.

If you fail to reinstate the lapsed grant within 90 days of suspension, SASSA will cancel the grant entirely, and any remaining funds will be reclaimed by the National Treasury. At this point, you would need to restart the application process from scratch for that particular grant type.

This stringent lapsed grant policy exists because SASSA’s funds are limited, and unused grant money needs to be redirected to other needy recipients if it goes unclaimed for an extended period. The agency cannot reasonably keep accruing unclaimed money indefinitely.

Avoiding Grant Lapses

To avoid any issues with your SASSA grant lapsing or being suspended, it is highly recommended that you claim and withdraw your grant payments as soon as they are available each payment cycle. Even if you don’t need to spend the full amount right away, at minimum you should withdraw some portion to reset the 90-day inactivity clock.

SASSA actually encourages grant recipients to withdraw funds incrementally throughout the month, rather than taking the full lump sum at once. This approach helps reduce the risk of crime, as criminals may target recipients who withdraw large amounts on SASSA paydays.

If you absolutely cannot access or withdraw your grant money immediately due to circumstances, you at least have that 90-day buffer period before issues arise. However, you should make claiming the grant a priority to avoid unnecessary suspension hassles.

Keeping SASSA Card Funds Safe

While SASSA permits you to leave money loaded onto your SASSA card between payment cycles, it’s generally advisable to transfer any funds you don’t need immediately into a secure bank account. Keeping large cash amounts on a SASSA card increases the risk of loss or theft.

If you do choose to leave money on your SASSA card for an extended period, be sure to make at least some minor purchase or withdrawal every 90 days to prevent the account from lapsing due to inactivity.

Checking for Unclaimed Grants

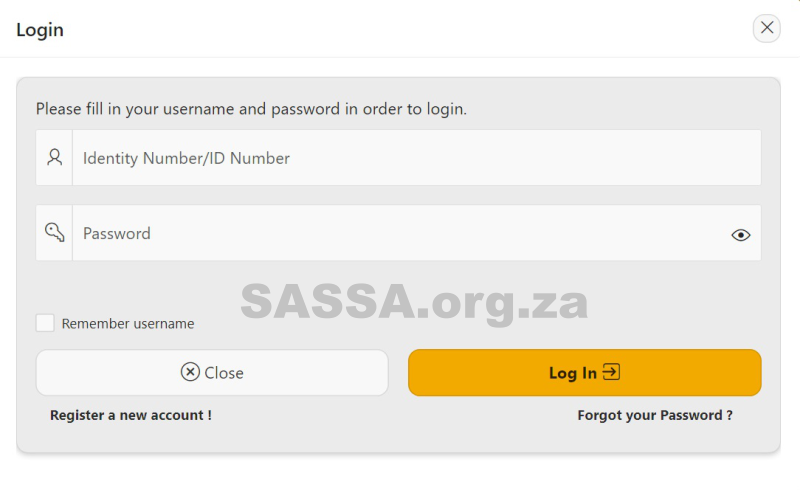

If you have applied for a SASSA grant, particularly the temporary SRD grant, and are unsure if you have any outstanding unclaimed payments, there are a few ways to check:

- Visit your nearest SASSA office and provide your ID number to check payment status

- Log into your account on the SASSA website or mobile app

- Call the SASSA toll-free number at 0800 60 10 11

Any unclaimed grant payments you are owed should appear in your account details. Be sure to claim these promptly before the 90-day lapse window closes.

FAQs on SASSA Grant Expiration

Does SASSA money actually expire if not withdrawn?

SASSA grant money itself does not technically expire, but if left completely untouched for 90 days, the grant can lapse/suspend, putting the funds at risk of being reclaimed.

How long can I leave money on my SASSA card?

While there is no set expiration, if you leave SASSA card funds completely untouched for over 90 days, the account may be suspended. To prevent this, make a minor transaction every 3 months.

What if my SASSA account is suspended after 90 days?

You have a further 90-day window to apply and get the suspended grant reinstated. If you miss this window, the grant will be permanently canceled.

Can I safely withdraw my full SASSA grant at once?

While you can withdraw the full grant amount, SASSA recommends staggering withdrawals throughout the month for safety reasons, as lump sums can make you a target for criminals.

How can I avoid my SASSA grant expiring or lapsing?

Be sure to claim and withdraw at least a portion of your grant every month/payment cycle before the 90-day inactivity period closes.

Final Thoughts

In conclusion, while SASSA grants themselves don’t technically expire, recipients need to be diligent about consistently accessing and withdrawing their grant money to some degree, even if not the full amount. Letting a grant go completely untouched for over 90 days puts you at risk of suspension and potential cancellation. By understanding these policies and claiming grants promptly, you can ensure your vital SASSA financial support remains uninterrupted.

Alistair trout lost cell no and i don’t remember my cell phone number please

I want to stop my sassa application for good because I’m going to apply for National student fees